Many

people who work in large organizations always say they do not need a medical

card because they already have their own group medical scheme . Is this right? The answer is definitely NO , let me explain to you why ?

Even if someone already has a group of medical schemes, I still advise them to have a medical card itself while they are still healthy. Here are some of the reasons?

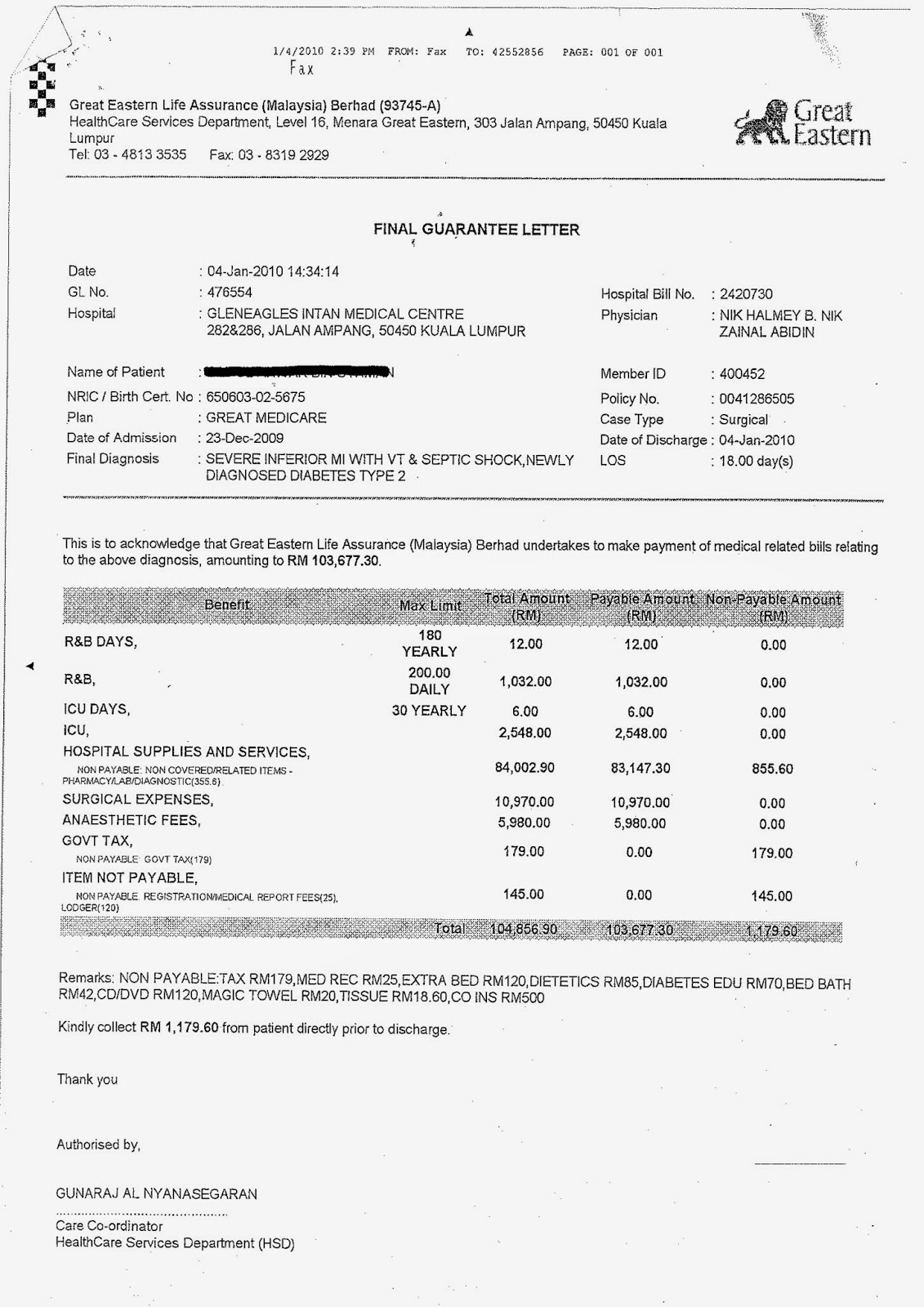

1) Group medical Scheme is an additional benefits to employees of a company and it is free. Such schemes usually have limited coverage and always inadequate. I once knew an incident where an Enginneer who work in sony only has a limit of RM5,000 for each hospitalization and it is not able to bear his hospitalization bill of RM 15,000.

2) Group medical scheme only protect an employee while they are still working in the company. The scheme will be terminated if the person has left the company or after a person has retired. Many think that they will only take a medical card after retirement. As a result, they will face the following possibilities:

a) They have to pay high premium . for example: premium for one who is aged 25 is RM 150 a month whereby a person aged 55 need to pay RM 600 a month and above.

b) They may not be eligible to enter into any medical insurance if they already have certain health problems like diabetes etc

c) If the person is still eligible to enter the medical police after he retired, it also meant he had to continue to pay premium after retirement and this may cause a considerable burden.

3) There is a dispute that their group medical schemes can continue to provide protection after they retire. My advice is do not take it as a WARRANTY. Companies can say that they can provide such benefits now but they did not give any warranties that they can continue to benefit this way forever. They may change from time to time and I've seen many examples of this.

So, consider group medical scheme benefits a bonus and one still must have a medical card itself while still young and healthy. The saddest thing is no longer eligible to enter the medical card after retirement. Those in this category had to bear 100% of the cost of their treatment and this is indeed a very worrying situation.

Even if someone already has a group of medical schemes, I still advise them to have a medical card itself while they are still healthy. Here are some of the reasons?

1) Group medical Scheme is an additional benefits to employees of a company and it is free. Such schemes usually have limited coverage and always inadequate. I once knew an incident where an Enginneer who work in sony only has a limit of RM5,000 for each hospitalization and it is not able to bear his hospitalization bill of RM 15,000.

2) Group medical scheme only protect an employee while they are still working in the company. The scheme will be terminated if the person has left the company or after a person has retired. Many think that they will only take a medical card after retirement. As a result, they will face the following possibilities:

a) They have to pay high premium . for example: premium for one who is aged 25 is RM 150 a month whereby a person aged 55 need to pay RM 600 a month and above.

b) They may not be eligible to enter into any medical insurance if they already have certain health problems like diabetes etc

c) If the person is still eligible to enter the medical police after he retired, it also meant he had to continue to pay premium after retirement and this may cause a considerable burden.

3) There is a dispute that their group medical schemes can continue to provide protection after they retire. My advice is do not take it as a WARRANTY. Companies can say that they can provide such benefits now but they did not give any warranties that they can continue to benefit this way forever. They may change from time to time and I've seen many examples of this.

So, consider group medical scheme benefits a bonus and one still must have a medical card itself while still young and healthy. The saddest thing is no longer eligible to enter the medical card after retirement. Those in this category had to bear 100% of the cost of their treatment and this is indeed a very worrying situation.